Margin Buying And Selling Crypto: How To Commerce Bitcoin With Leverage

Check out the Trality’s Python Bot Code Editor — a strong browser-based software designed for merchants who want to build, backtest, optimize, and reside trade with algorithmic buying and selling bots. We supply the highest ranges of flexibility and class available in private buying and selling. The longer the loan, the more money you’ll pay when it comes to interest and upkeep https://www.xcritical.com/ charges. That’s why it’s necessary to borrow for the quick time period in order to decrease larger interest and costs. If we recall the example of Kraken, just because a trader may be eligible to borrow up to $500,000 doesn’t imply that s/he should borrow the maximum amount. Rather, a prudent approach would be to borrow lower than the allowed limit.

Stop-losses are perhaps the best software in threat administration when buying and selling on leverage. A stop-loss closes your commerce routinely when the worth reaches a pre-specified level, allowing you to precisely decide your potential losses earlier than even putting a trade. Besides overtrading, many traders make another rookie mistake by not defining or respecting their threat administration guidelines.

What’s Margin Buying And Selling Cryptocurrency?

Fortunately, the rise in danger when margin buying and selling crypto is not proportionate to leverage. Trading with 100X leverage, for example, won’t multiply your losses by 100X — it’s most frequently not attainable to lose greater than you originally commit crypto margin trading exchanges to a trade. However, losses can theoretically exceed dedicated assets in particular eventualities. Attempting to decipher the sophisticated world of crypto margin buying and selling can shortly overwhelm a extra moderen trader.

Now think about if this increased exposure may yield exponentially larger profits throughout bull and bear markets. In addition, it should be remembered that borrowing funds for margin buying and selling usually incurs curiosity costs, which might erode income, especially during prolonged trading durations. Unfortunately, the market strikes against her expectations, and the price of SOL declines instead of rising.

Actively Monitor Your Leveraged Trades

It’s akin to receiving a loan out of your brokerage, allowing you to invest in extra property than your cash reserves would usually permit. PrimeXBT is a quantity one supplier of leveraged cryptocurrency merchandise that let you take full benefit of margin trading. When used accurately, even a small price motion can amplify your potential profits and develop your buying and selling account. Put differently, “maintenance margin” is the amount of capital a trader wants in their account or sensible contract to keep their commerce open. A good margin ratio in crypto buying and selling is often thought of to be above 100%. This signifies that the trader’s fairness is greater than the used margin, on open positions providing a buffer towards potential losses and reducing the danger of liquidation.

Instead, spinoff traders enter contractual agreements speculating on the future worth of a digital forex. When the margin account drops below the maintenance margin requirements, the brokerage or trade notifies the dealer to deposit extra collateral or promote assets to make up for the drop in position value. With the flexibility to take bigger positions, merchants could make larger earnings (and losses) with margin trading. The borrowed cash is repaid after the trade, while the trader enjoys the earnings of the trade in full. This could be very important not solely during bear markets, as previously mentioned, but in addition when opening brief positions that anticipate downward worth movements, as within the case of the current crypto market. Crucially, “shorting” allows an investor to profit whether or not the market is shifting up or down, making margin trading one thing that you can do in any market situation.

Trading on margin is extraordinarily popular amongst retail traders because it allows for a significant market publicity with a relatively small trading account. Margin buying and selling has been well-liked in different markets as well, corresponding to foreign exchange for example, and cryptocurrencies aren’t any exception. Traders should be cautious when using leverage, as they may even be responsible for the losses of the increased place measurement. It is essential to comprehend the nuances of margin trading earlier than placing any buying and selling capital in danger. It’s necessary to note that though crypto margin buying and selling is legal in the United States, it’s tightly regulated. As a end result, many in style platforms don’t supply margin buying and selling services to American traders.

- Consider investing in cryptocurrencies solely after careful consideration and analysis of your own analysis and at your own risk.

- The actual liquidation worth in this example could be a little greater than 50% less than the purchase worth because part of the fee to open the position consists of charges and interest.

- Margin buying and selling can magnify each features and losses, so it carries the next degree of risk in comparability with traditional trading.

- Leveraged tokens aren’t exclusive to Bybit however this trading platform has decent liquidity and volumes in comparability to its competitors.

- In isolated margin buying and selling, each buying and selling place is separated or isolated from the relaxation of the dealer’s funds.

Traders usually goal to hold up a margin ratio above 100% to ensure they’ve sufficient margin to cowl market fluctuations and keep away from being compelled to close their positions prematurely. Margin buying and selling permits the power to borrow an asset and sell it immediately. Short promoting is advantageous in bear markets as profits could be made when costs decline. And, as we are able to see in the charts beneath, margin buying and selling and shorting test outcomes using Trality’s backtester show a significant increase in income when compared to a long-only technique. Depending on whom you ask, margin buying and selling may be perceived as dangerous business.

Scholar Loan Refinancing

Overtrading means opening trading positions out of the danger boundaries that you’re able to manage. It’s straightforward to fall into the trap of trading on very excessive leverage ratios which may push your buying and selling account over a cliff. Crypto margin trading — or ‘buying crypto on margin’ — is the process of borrowing money out of your trade to buy cryptocurrency. You’ll be required to pay back the borrowed funds with interest at a later time. BitMax, for example, is a extremely in style change that gives leveraged buying and selling of as much as 100X with variable interest rates — one of many highest leverage Bitcoin buying and selling platforms online. The interest rates offered by BitMax may be as low as three.65% per 12 months, or zero.01% per day, which is a highly favorable price for short-term positions.

In a margin account, your deposited cash acts as collateral for a loan, enabling you to borrow up to 50% of an funding’s purchase price. For example, with a $5,000 deposit, you could invest up to $10,000 in stocks or cryptocurrencies. Margin trading, a strategic method in the Bitcoin and cryptocurrency markets, includes borrowing funds from a dealer to buy shares or digital property.

Mention the words “credit” or ‘loan” and some traders will freeze sooner than Celsius on a sizzling summer’s day. But purchasing crypto (or securities, for that matter) on margin is a standard funding follow for many. When’s the last time that you heard of somebody shopping for a flat or house and paying for it in full.

Had he not used borrowed funds, his revenue on this commerce would have been solely $100 or 10% of his initial investment. You can do that by adding more cash or selling belongings to increase cash in your account. Remember, as lengthy as you meet your obligations, like timely curiosity payments on borrowed funds, you can maintain your loan indefinitely. When you promote stocks in a margin account, the gross sales proceeds first go in path of repaying your dealer for the mortgage, progressively lowering your borrowed quantity.

As the value continues to fall, Emily receives a margin name from the change because the worth of her position has fallen under the required margin degree. However, price movements are often primarily influenced by market fundamentals, which is why you should always have them on your radar. Before placing a leveraged trade, check how correlated markets are performing, similar to equities or rates of interest. To purchase a complete Bitcoin, you’ll need to allocate only 1% of the commerce as the collateral (margin) for the commerce. The remaining 99% of the required funds might be made out there by your broker as a mortgage.

As you close the commerce, the margin is automatically returned to your account stability. After all, it only acts as collateral for the funds borrowed out of your broker. You have to have sufficient funds in your crypto buying and selling account to cowl the margin quantity, and also some further funds that type a buffer in case the leveraged commerce starts to go in opposition to you. Before you get started with margin trading, it’s important to take a look at your exchange’s payment structure.

Tips For Crypto Margin Trading

While the involuntary promoting of property may sound distasteful, it’s a protecting measure. In the case of Kraken, for example, the margin liquidation stage is approximately 40%, however the exact stage can differ based mostly on worth volatility. Let’s take a quick take a glance at an overview of the process earlier than delving a bit deeper into the specifics involved. Buying on margin is a type of trading whereby the dealer takes out a loan from an exchange to find a way to buy more crypto than s/he otherwise would have been capable of do given their current cash/coin balance(s).

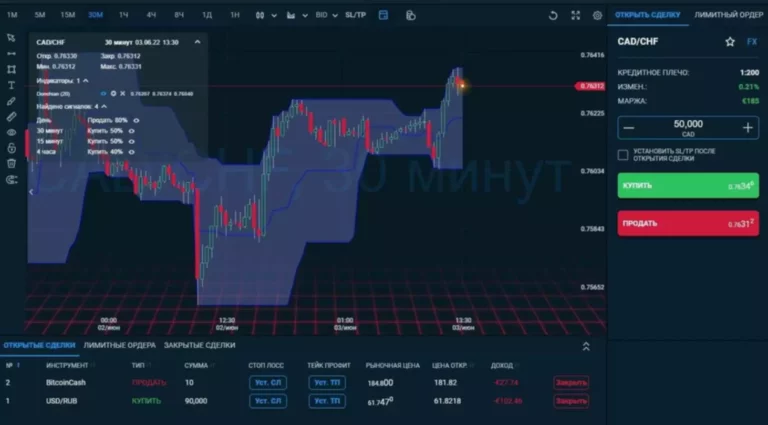

Choosing the best bitcoin leverage trading platform is normally a difficult process — there are many exchanges on-line at present that offer leveraged trading. Trading on the highest leverage crypto trading platform just isn’t all the time the most fitted choice. There are a selection of necessary factors that ought to be thought-about when selecting margin buying and selling crypto exchanges.

After a crash in the crypto market, the worth of Wyla’s BTC falls to $3,000. In this example, Jason places in $1,000 of capital and makes a return of 100%! Had he invested his personal cash, he would have only made a return of 20%.

Related Posts

What Does A Market Maker Do, Anyway? Its About Bridg

Categories

- ! Без рубрики

- 1Win Brasil

- 1winRussia

- 1xbet russia

- 1xbet Russian

- Artificial intelligence

- asian brides

- asian mail order bride

- Aviator

- Bahsegel giris

- best dating reviews

- best dating sites

- best dating sites for over 40

- best mail order bride sites

- best mail order brides sites

- Betpas_next

- Bettilt

- Bettilt_new

- Betzula

- blackjack-deluxe

- Blog

- Bookkeeping

- Bootcamp de programação

- Bootcamp de programación

- brides

- Business

- casino

- casinom-hub.comsitesi apr

- casinomhub_may

- chinese mail order brides

- colombian mail order bride sites

- Counter Strike 2

- Cryptocurrency News

- dating japanese women

- dating reviews

- dating sites

- dating sites guide

- dating women online

- dj tools reviews

- Education

- filipino women

- find a bride

- find a bride online

- find a wife

- find a wife online

- find beautiful wome

- FinTech

- Forex Trading

- Galabet

- german mail order bride

- heylink.memostbet-giris_may

- Hitbet

- IT Вакансії

- IT Образование

- IT Освіта

- japanese mail order wife

- japanese women

- JetX

- Jojobet

- korean mail order brides

- latin brides

- latin mail order brides

- latin women for marriage

- Law

- LuckyJet

- mail order bride

- mail order bride review

- mail order brides catalogue

- Marketing

- Marsbahisgiris

- MarsMaksBahis

- mostbet azerbaijan

- mostbet-ru-serg

- Office

- online dating

- Pin Up Brazil

- polish brides

- russian mail order brides

- Sober living

- Software development

- thai women

- top dating sites

- Uncategorized

- wife finder

- women features

- women for marriage

- Youwin

- Весільні та Вечірні Сукні

- Криптовалюты

- Пачка Ru

- Финтех

- Форекс Брокеры

- Форекс Обучение